How to Grow Without Venture Capital

Written by Dave Bailey

What if you could grow faster without raising another round? Learn the customer-funded acquisition tactics founders can apply to speed up growth without dilution.

You assumed your next raise would be easier than the last one.

After all, you've already raised money to build your product and generate your first revenues. And you did it, proving that you can build the product and that people are willing to buy.

But as you keep getting no's from investors at the next round, you suddenly realise you're fighting a losing battle.

With a small cut and a bridge fund from existing investors, you're able to extend the runway to a reasonable amount, and maybe even reach break-even.

Hurray! You don't need venture capital, at least for a while...

But you also want to grow, because if you don't, you risk turning into a zombie company—one that neither grows nor dies… it just survives.

Now you have to wrestle with a new question: How can you grow without venture capital?

The Reason Founders Raise Money

For a lot of tech founders, raising money is just something they do. But it's worth unpacking how venture capital translates into growth.

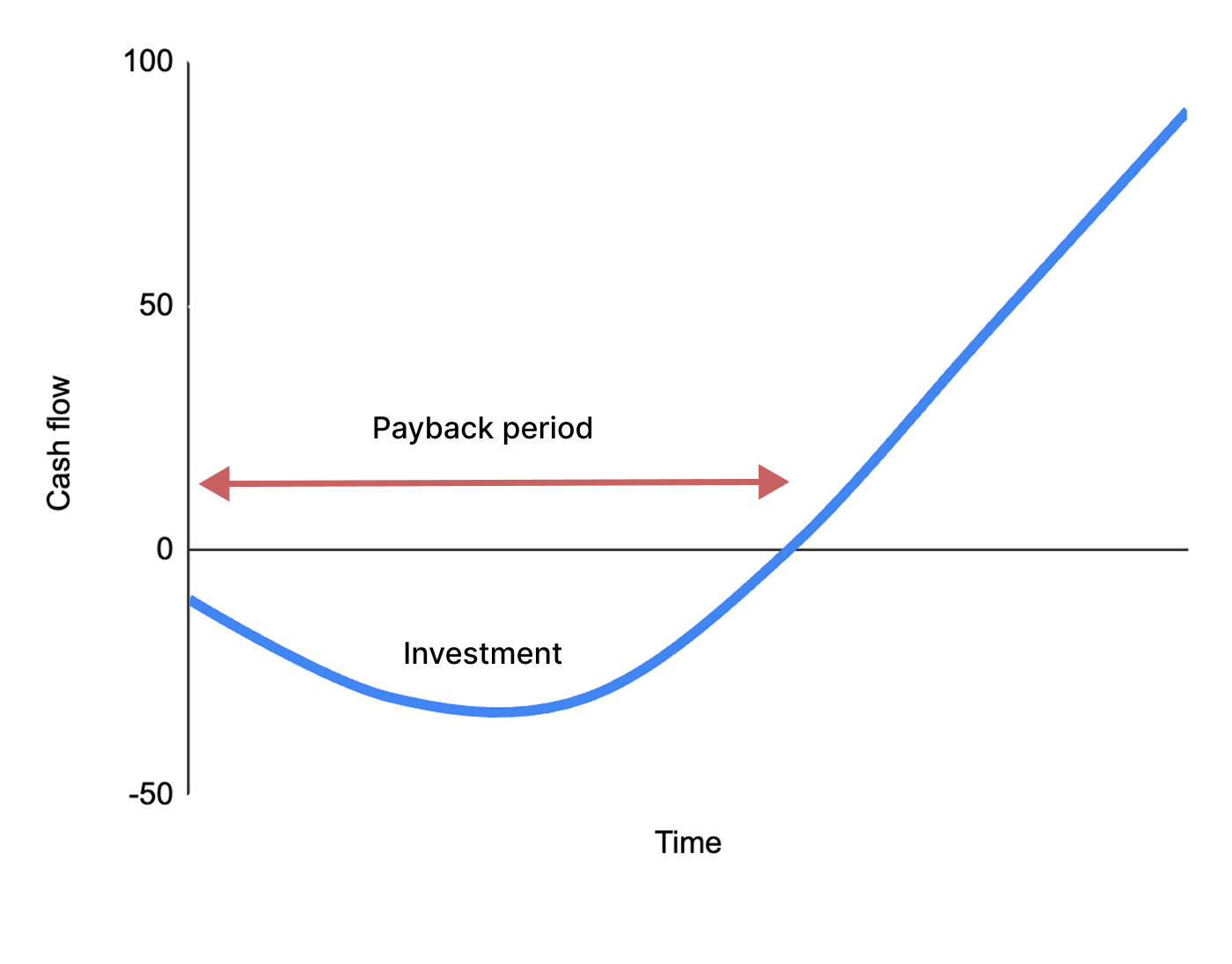

Every investment follows what’s called a ‘J-curve’.

- During the investment phase, the curve slopes downwards.

- When the investment starts paying off, usually as revenue, the curve turns up.

- Eventually, you pay back your initial investment, and you’re finally making a return.

At the start of a venture, the beginning of the J-curve is investment into product development. This narrative may work with seed investors, but many later-stage investors want to invest in growth, not product development.

These investors want to know that you can use capital to acquire new customers, drive revenue and increase your enterprise value to guarantee a return on their equity.

Customer acquisition follows a J-curve too. At the beginning you invest in customer acquisition, i.e. ads, sales teams, partnerships, etc. Then, at some time in the future, you recoup this money in the form of revenue.

When growth investors aren’t interested, you’ll need to find this acquisition J-curve in a different way.

Customer-Funded Growth

I picked up the following idea from Alex Hormozi, who’s better known for selling information products than for growing venture-backed businesses.

If you want to move from investor-funded growth to customer-funded growth, you need to shorten payback time so that existing customers pay for the acquisition of new customers.

Let’s look at two companies: one that requires venture capital to grow, and one that doesn’t.

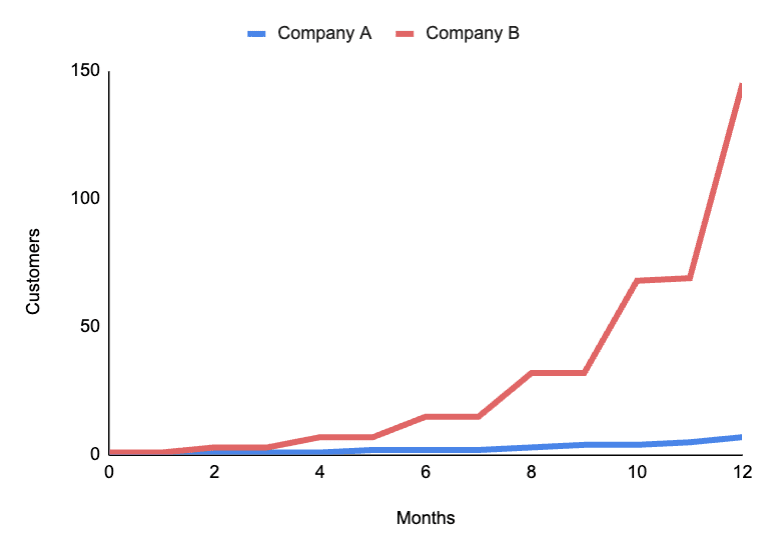

Company A: Slow Growth

CAC = $30, acquisition cycle = 2 months, and price is $10 per month.

By the beginning of month 3, you’ll have $30, which you can reinvest into one customer who’ll arrive in month 5.

So by month 5, one customer has financed one new customer.

Company B: Fast Growth

CAC = $30, acquisition cycle = 2 months, and they charge $30 per quarter, with a $30 joining fee which includes an online training course, which is refunded in month 4 if the customer doesn’t cancel.

The initial payment of $60 from the customer instantly fuels the acquisition of 2 new customers, which join at the start of month 3.

Their initial payments then fund two new customers each (that’s an additional 4 new customers), who join at the start of month 5.

By continually reinvesting the initial payments of new customers, by month 5, one customer has financed 6 new customers.

The 4X difference in new customers did not require any external funding.

And at the end of four months, customers have paid both companies the same amount of revenue.

The only difference is Company A waits months to recover its CAC, while Company B recovers it immediately—and uses that upfront cash to acquire more customers right away.

After 12 months, the compounding effect of fast payback is astounding: 24X more customers, all acquired through customer-financing.

No venture capital needed.

The Customer-Financed Growth Factor R

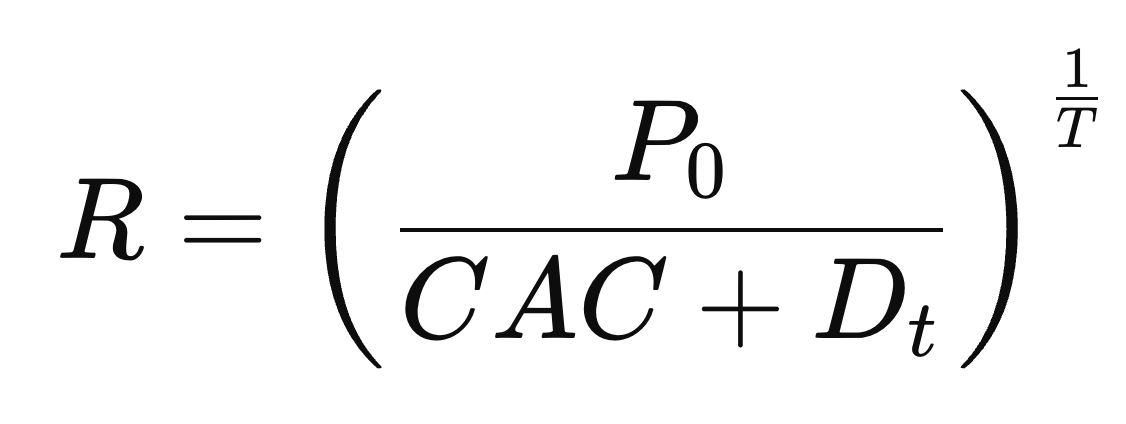

You can get really fancy with customer-funded models, but the following formula is a helpful simplification.

However, it’ll help you separate the most important variables in eliminating the need for external funding.

Some maths is coming, so take a deep breath… I’ll take you through it step by step.

Where:

- R = monthly growth factor from initial customer payments

- P₀ = initial customer payment

- CAC = cost to acquire a customer

- T = acquisition cycle time in months

- Dₜ = cost to deliver during T

This looks a bit complicated, so let me explain what it means in plain English.

- When the initial customer payment covers the cost of acquisition and the delivery cost of a new customer (i.e. P₀ > CAC + Dₜ), then the next customer can be completely financed by the previous customer.

- If your sales cycle takes, say, 2 months, and one customer gives you enough money to create one more, then customers take two months to double. So we take the square root to turn a “2-month doubling” into its “per-month equivalent.”

As founders, it’s intuitive to focus on reducing CAC, acquisition or sales cycle time, or the cost to deliver the service. However, we often fail to recognise the importance of the first payment, because we think “we’ll get it back eventually.”

But “eventually” is the root cause of needing to raise working capital. If you get it back immediately, the entire J-curve can be financed by customers.

Therefore, if you want to finance the J-curve with customers, you need to increase the size of the initial customer payment, P₀.

How to Engineer Higher Initial Payments

The first step in driving customer-funded growth is to calculate CAC + Dₜ i.e. the cost to acquire the customer and deliver your service during the following acquisition cycle.

For example, say it costs $20 to acquire a customer, the sales cycle is two months, and it costs you $10 to service the customer over this time period.

Then your target for P₀ is at least $30, which pays for the delivery of their service, and the acquisition of the next customer.

That way, every customer immediately pays for the next one, and you don’t require external investment to cover the cost of acquisition.

There are two ways you can achieve this, and you may decide to do a combination of both.

Method 1: Optimise Your Payment Plans

This method is purely about taking payments faster. Many tech companies default to monthly subscriptions or billing, but you could equally do this:

- Eliminate monthly plans and just sell quarterly plans. This will triple your P₀.

- Incentivise an annual plan as a first purchase with a promotion. If a quarter of users opt for this plan, you’ve tripled P₀ (25% * 12 months).

- Promote the annual plan to your most active customers in week 1. “We see you’re using the service a lot… would you like to save 15% by getting on the annual plan?”

- Allow people to buy an annual plan, but receive a pro-rata refund according to the monthly fee if they cancel. This makes it a no-brainer for customers while giving you upfront cash.

- Take an initial deposit which is repaid within X months or upon cancellation.

Changing your payment plan may alter your CAC and/or ARPU (average revenue per user), so this requires experimentation.

But don’t forget our goal right now isn’t to maximise APRU, it’s to reduce the need for external investment while growing the business!

Method 2: Create a More Valuable (and Expensive) Starting Offer

The other way to achieve a higher P₀ is to roll up your sleeves and offer more value upfront. This is a real blind spot in the venture capital space.

And yet, when the customer first makes their purchase, it’s because their pain is really acute—and this is an opportunity to sell more to people with acute pain.

Here are a few examples of ways to increase the size of the first payment:

- Include a set-up fee or deposit—which you can discount to attract the sale, or give back if the customer churns.

- Add in high-value services—a paid onboarding session, a consulting project to ensure they get the most out of the product (e.g. Superhuman used to provide 30-minute sessions for new customers).

- Add in digital bonuses—access to pro features in month 1, an online course, “lifetime access” features positioned outside of the main offer.

- Send a physical product—include a high-margin physical product to accompany the software (e.g. Second Nature offers a weighing scale as part of the initial payment).

- Offer a bundle of discounts—partnering with non-competitive providers willing to offer something free of charge (e.g. Lenny’s newsletter bundles extended free trials of AI products).

Your goal is to increase the average P₀ across all customers. This means you can double P₀ by offering 20% of your customers an onboarding option that’s 5X the price for that month.

Ask yourself: What can you offer your best customers who can afford to pay you more?

This exercise is limited only by your creativity, your fear of charging higher prices, and your ability to write compelling marketing copy for a new offer.

I’ve worked with my clients to integrate this into both consumer and B2B businesses, and low and high price points. It’s a very high ROI exercise.

Why Don’t More Venture Founders Do This?

There are a few reasons why customer-funded growth is a blind spot for CEOs and VCs.

- Customer-funded growth reduces the need for venture capital, so if VCs taught it, fewer entrepreneurs would want to take their money (even though you can do both).

- Customer-funded growth can increase friction by making the service appear less affordable (even though friction can improve retention).

- Customer-funded growth can rely on an initial service element, which especially in the B2B space is seen as ‘unscalable’ and could hurt your multiple (even though growth is king).

Many B2B SaaS companies have an irrational fear of offering services, but many find that offering services can unlock growth.

For example, a B2B company that offers a $20,000 upfront consultation that’s highly valued by customers, increases the chance of long-term retention, and costs you $5,000 to deliver, increases their P₀ by $15,000, which can offset or pay back acquiring the next customers.

That’s real, customer-funded growth.

Venture or Customer-Funded Growth?

Not being able to raise venture capital forces you to get serious about customer-funded growth. But this isn’t an either–or decision… it’s a both–and.

Even if you can raise venture capital, optimising your customer-funded growth factor can have a massive impact on your growth.

When a customer’s first purchase is 2x their CAC and delivery costs, every sales cycle doubles the capital you can reinvest into growth. And when you double each cycle, the compounding effect becomes explosive.

And when you’re sophisticated about payback, you unlock alternative financing—traditional debt, venture debt, and cohort-based financing—that doesn’t require dilution, because you’ve reduced both payback time and risk.

In a world obsessed with slashing CAC, the real competitive edge is how quickly and how much value you can capture from each customer.

For the ambitious entrepreneur, that’s the difference between needing investors… and choosing them.

Related Reading

- What to Do Immediately After a Fundraise

- How to Run Your Pitch Meetings

- How to Craft a One-Sentence Origin Story

Originally published on November 19, 2025.

How do top founders actually scale?

I’ve coached CEOs for 10,000+ hours—here’s what works.

Join 17,000+ founders learning how to scale with clarity.

Unsubscribe any time.